How to Pay Estimated Taxes

(Quarterly)

Welcome business owners, freelancers, stock option liquidators, and other estimated tax-paying folks!

We have built this step-by-step guide to show you how to make estimated tax payments for both the federal and New York state governments. Other states have a very similar process.

The cover letter on your prior-year tax return should have listed “estimated tax payments” on the second page for your federal tax return and your state return. If not, estimates may not be required. Maybe you’re here because we’ve asked you to make a payment or you’re just going for it because it seems like a sensible thing to do.

TAX STATE ONLINE PAYMENT LINKS

| Jurisdiction |

|---|

| Alabama |

| Arizona |

| Arkansas |

| California |

| Colorado |

| Connecticut |

| Delaware |

| Georgia |

| Hawaii |

| Idaho |

| Illinois |

| Jurisdiction |

|---|

| Indiana |

| Iowa |

| Kansas |

| Kentucky |

| Louisiana |

| Maine |

| Maryland |

| Massachusetts |

| Michigan |

| Minnesota |

| Missouri |

| Jurisdiction |

|---|

| Mississippi |

| Montana |

| Nebraska |

| New Hampshire |

| New Jersey |

| New Mexico |

| New York |

| North Carolina |

| North Dakota |

| Ohio |

| Oklahoma |

| Jurisdiction |

|---|

| Oregon |

| Pennsylvania |

| Rhode Island |

| South Carolina |

| Tennessee |

| Utah |

| Vermont |

| Virginia |

| Washington DC |

| West Virginia |

| Wisconsin |

Remember that estimates are due at the end of each quarter:

Q1 is due by April 15th

Q2 is due by June 17th

Q3 is due by September 16th

Q4 is due by January 15th

Please note: the IRS website and state payment websites almost ALWAYS crash right at the deadline due to millions of taxpayers trying to log in at the same time, so please be sure to make your payment at least two days before these deadlines to avoid stress and frustration.

How to Submit Extension Payments

For Brooklyn Fi clients going on extension each March or April 15th, we have provided these video walkthroughs for you to help you avoid submitting an incorrect payment (for example, submitting an estimated payment instead of an extension payment).

Please use the guides below to submit your extension payment. If you have any questions, please reach out to your financial planner before submitting.

Friendly reminder that the IRS and States have separate submissions. We have provided NY and CA walkthrough below. If you need help with an additional jurisdiction please reach out to your financial planner/tax manager.

How to Pay Estimated Taxes to the Federal Government (IRS)

If you create an account, making a payment is MUCH easier. Go here and click “Go to Your Account”

What you need:

A prior year federal and state tax return handy to verify your identity.

A bank account number and routing number.

5 minutes

Step 1

Head to https://www.irs.gov/payments/direct-pay

and select “Make a Payment”

Step 2

If you’re making an estimated tax payment for the current year:

Indicate estimated tax payment for the year.

If you’re making an extension payment related to the prior tax year:

See the next section

If you’re making a payment for another reason like a prior year extension payment, select a different option from the drop down menu.

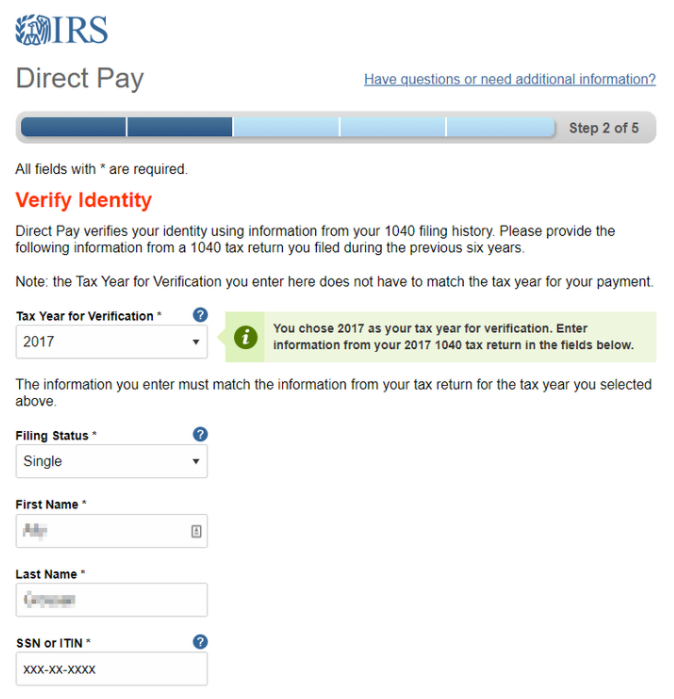

STEP 3

Verify your identity from a copy of a prior year tax return. You can choose any prior year. You must enter information exactly as it appears on the old return, even if your address is different now.ce.

STEP 4

Enter the payment amount and the date of withdrawal (make sure it is before one of the quarterly deadlines). Be sure to select “email confirmation notifications”. Then accept the disclosure.

STEP 5

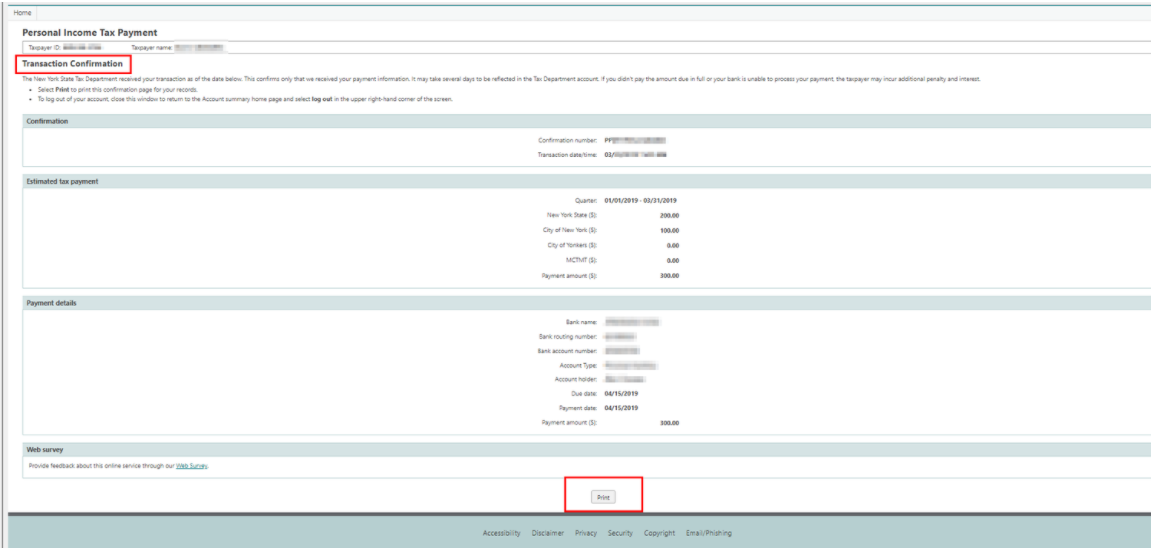

Record the date and amount of your payment.

Now, this is perhaps the most important step of all! A screenshot like this one is best.

The IRS has record of your payment but it is up to you to self-report it (and tell your tax preparer (sup)!!) on your tax return. Therefore, you MUST record the date and amount of payment for easy access when it comes time to prepare your return.

Save the screenshot and email to a folder called “Estimated Taxes” on whatever cloud storage you like, This is EXTREMELY important because the email you will receive does not note the amount of payment or the date of payment.

HOW TO PAY ESTIMATED TAXES TO NEW YORK STATE

If you live in New York state and have 1099 or freelance income, you must ALSO pay estimated taxes here. This is in addition to the federal amounts and requires a different payment system. New York state has a pretty sweet flag.

If you live in another state, the process is VERY similar.

STEP 1

Create an account with New York State.

Go to: https://www.tax.ny.gov/pay/ind/pay-income-tax-online.htm

If you already have an account go to Step 4 to sign in.

STEP 2

Verify your identity by entering information from a prior year tax return from New York State (IT-201), just as you did at the federal level.

STEP 3

Create your account and set up the security questions.

STEP 4

Log in to your new account here: https://my.ny.gov/sreg/Login

STEP 5

Select “Make a Payment” from the left side menu

STEP 6

Select “Pay estimated tax”

If you’re making an extension payment for LAST year, select “pay my extension.”

STEP 7

Note the amount you want to pay to NY State and City. It all goes to the same place so one NY State payment is fine. Then you’ll select your payment method. Paying by credit card incurs a 2.5% service fee so a bank account is best.

STEP 8

Enter your bank information.

STEP 9

Review, verify and submit.

STEP 10

Save the confirmation. IMPORTANT!

New York State has record of your payment but it is up to you to self-report it (and tell your tax preparer (sup)!!) on your tax return. Therefore, you MUST record the date and amount of payment for easy access when it comes time to prepare your return.

Save the screenshot and email to a folder called “Estimated Taxes” on whatever cloud storage you like. This is EXTREMELY important because the email you will receive does not note the amount of payment or the date of payment.