What an Acquisition Means for Employees with Stock Options

By AJ Ayers, CFP®, CEP, EA

The news rocked the start-up world this week that software giant Adobe is set to acquire Figma. You’ve probably heard of Adobe or used one of its design tools like Illustrator or Photoshop to put your sister’s head on a hamster body (no, just me?). You may not have heard of Figma if you are not in the design or product development world. I’ve used Figma’s tools to collaborate with designers, and it rules. It’s a beautiful tool to build and collaborate on web designs, and apparently, Adobe agrees with me because the purchase price is set at $20 billion. The deal is a mixture of cash and stock. I’m speculating here, but it is likely employees will be paid out for some vested options and will be regranted unvested options as Adobe shares.

This news is a welcome win in the start-up space where IPOs have been few and far between this year. According to Renaissance Capital data, there were 397 IPOs in 2021 and there have been 63 in 2022. In better market conditions, could Figma have gone public at an even HIGHER valuation? Probably. Were shareholders impatient and wanted liquidity now? Probably. Their year-over-year growth has been incredible. According to analysis by TechCrunch, Figma is growing at about 100% a year which is very hard to do when your revenue is already in the hundreds of millions.

This deal takes Adobe’s competitor off the market. We’ll see in the coming months how they plan to use and grow the product. I was recently chatting with Brooklyn FI’s developer and he noted what’s so unique about Figma: Figma uses something called web assembly (WASM), which let them run high-performance code in the browser. Usually, your only option in the browser is JavaScript, but this lets them use languages like C++, which can be hundreds of times faster and is used for high-performance things like robotics and video games.

This acquisition is going to make the co-founders and executives of Figma very wealthy. The CEO stands to make $2 billion from the deal. But based on their funding history, I believe it will also make many employees very wealthy as well.

At Brooklyn FI, we have dealt with dozens of liquidity events, whether that’s an IPO, a secondary sale, a DPO or an acquisition. Honestly, my favorite type of liquidity event is an acquisition because it removes the tyranny of choice from the employee holding shares in the company. With an IPO, so many choices exist, and with a volatile stock price, employees are thrust into the emotional rollercoaster of deciding when to sell. With an acquisition, the price is fixed and typically cash is exchanged for existing shares and vested options. Often unvested shares are paid out or forfeited all together.

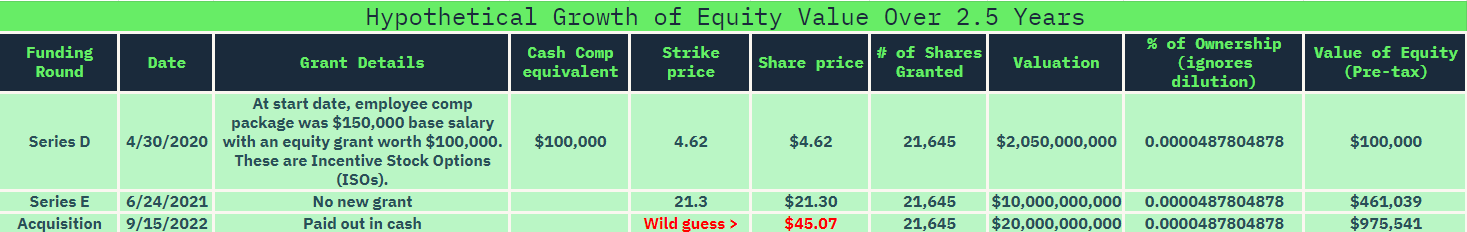

Let’s look at a hypothetical example of what might happen to an employee who recently joined a company, was granted stock options, and then went through an acquisition.

The history of a private company’s deals are actually public record if you check the Delaware corporation filings so we can learn some interesting things about private stock prices.

Let’s say you’re a Figma employee that joined on May 15th, 2020 and were granted roughly $100,000 worth of ISOs (or 21,645 shares at a strike price of $4.62). According to the registration of shares, you would have joined right after they closed a Series D round on April 30th. They raised $50 million and the post-money valuation was $2,050,000,000.

If you still hold those options and the acquisition goes through, you have a cash payout of almost a million dollars. Even if you never exercised those options, they would likely be cashed out in the acquisition based on the share price detailed in the deal.

I’m using a ton of assumptions here, by the way.

Assuming all unvested shares were paid out (not converted to Adobe stock)

I’m ignoring dilution of the share pool to make a point (this data isn’t available)

The value of the equity at acquisition is just shy of a million dollars. We could expect this employee to pay roughly 50% in income taxes if they had not previously exercised options.

So what typically happens to your stock options in an acquisition?

Shares you have already exercised and held

These are typically paid out in cash at the share price related to the deal.

If you’ve held those shares for more than one year, you could pay the lower capital gains tax rate.

Sometimes shares are converted to the acquiring company’s stock, this is typically NOT an ideal outcome for employees who just wanted to enjoy their liquidity event.

Vested stock options

This is where itgets interesting. Sometimes they are treated like shares and typically paid out net of your strike price.

Sometimes there is a brief window to exercise the options before the transaction closes and the shares are then converted to the acquiring company’s stock.

Unvested options

Depends on how the deal is structured and how it favors employees.

Worst case: the grants are canceled and employees are SOL.

Typically, new grants are issued for unvested options in the acquiring company’s stock.

For many employees, the best-case scenario is a full cash-out where the unvested options are exchanged for cash (not always paid in one lump).

I’ve seen some generous scenarios recently where the acquired company negotiated for all vested and unvested stock options to be paid out in cash at the time of acquisition – but with an escrow agreement where the employee has to stay at the new company for a certain time period (typically a year or two).

If you’re going through an acquisition the best thing you can do is hurry up and wait. Information may be slow to trickle down from the lawyers and accountants involved in the transaction to your inbox. You may get to decide if you want to take your payout in stock or in cash and you should be prepared to stick around for at least a year or two to receive your full payout.

Company acquisitions are often surprises to employees so the best thing you can do as an employee with equity is bury your head in the sand. No, I’m kidding. Don’t do that. The best thing you can do is understand what you own and make a plan for how you might handle a liquidity event. That plan might include using a certain amount of cash to pay off loans, buy a home, or quit the high-paying stressful job you hate. The Brooklyn FI team has seen it all and specializes in helping our clients navigate the taxes and investment opportunities that come with equity compensation. Happy selling!

PS…If you’ve made it this far, you may enjoy this webinar we hosted last year called “How To Prepare for an IPO.”