Leaving Your Job? What to Do if You Have Equity

By Mark Stancato, CFP®, EA, ECA, CRPS®

Equity compensation can be a great employee perk. That’s because it essentially gives you an ownership stake in the company. Most organizations adhere to a vesting schedule, which will largely determine what you can do with your equity and how.

Equity compensation is primarily used to attract and retain talent, according to a recent Morgan Stanley report. It’s currently offered by 43% of public companies and 35% of private ones. But what happens to your equity if you choose to leave your job? Here’s a checklist of important factors to consider.

1. Confirm Your Award Type

There are a variety of equity compensation arrangements, each with its own attributes. For example, some may have exercise provisions. When you exercise a stock option, you choose to purchase the company’s stock. This may be at a discounted price. In some cases, the company may allow you to do so before you’re vested.

Other equity compensation arrangements are considered full-value awards that become yours after meeting the vesting requirements. Look to your program’s grant notice to verify the type of award you have and the specifics of the vesting schedule. You’ll also want to review the termination period. It should spell out the terms of your post termination exercise (PTE) period. This time period, which is typically 90 days from termination, is very important. It represents the window of opportunity for exercising any remaining vested options. After this period ends, you will no longer be eligible to purchase vested shares.

Helpful Hints:

Most companies offer a PTE window of 90 days, but some companies offer up to a 10-year window. Check your documents and plan accordingly.

Incentive stock options (ISOs) are a little different. Even if your employer offers a PTE window that’s longer than 90 days, you must exercise all remaining vested ISOs to keep their special tax status. Any remaining ISOs that are not exercised after 90 days will automatically convert to non-qualified options—and will lose their special tax status.

Different Award Types

Incentive stock options (ISOs): This allows you to buy stock shares at a discount. There may also be additional tax breaks on gains.

Non-qualified options (NSOs): With this employee stock option, you pay income tax on the difference between the grant price and the price that you actually exercise option.

Restricted stock units (RSUs): You receive stock units based on an internal distribution schedule and vesting plan.

Restricted stock awards (RSAs): Company stock is granted to the employee, but their rights in the stock are restricted until they meet vesting requirements.

Stock appreciation rights (SARs): This award is typically paid in cash and is tied to the company’s stock price during a predetermined time period. That’s good news if stock prices increase during this time. As an employee, you aren’t required to own any assets.

2. Clarify the Terms of Your Exit

It’s important to understand the terms of your employment arrangement and the circumstances around your departure. Be sure to check your equity incentive plan (EIP) document, which should state how your company defines each of the reasons below—and how it will impact the vesting of your equity compensation.

For example, most plans have a carve-out for sick leave and military leave that allows vesting to continue under the definition of “continuous service.” But things could be different with a leave of absence that’s longer than 90 days and doesn’t guarantee re-employment. In this case, it may be considered a termination on the first day immediately following the end of the three-month period.

Lastly, review the EIP document to understand the plan term, which is the length of time the equity compensation plan is in effect. For most plans, that’s 10 years from the date the board adopted the plan or when it was approved by shareholders; whichever is earlier.

Different Reasons for Leaving

Voluntary termination

Involuntary termination

Leave of absence

Sick leave

Disability

Military leave

3. Understand the Tax Impact

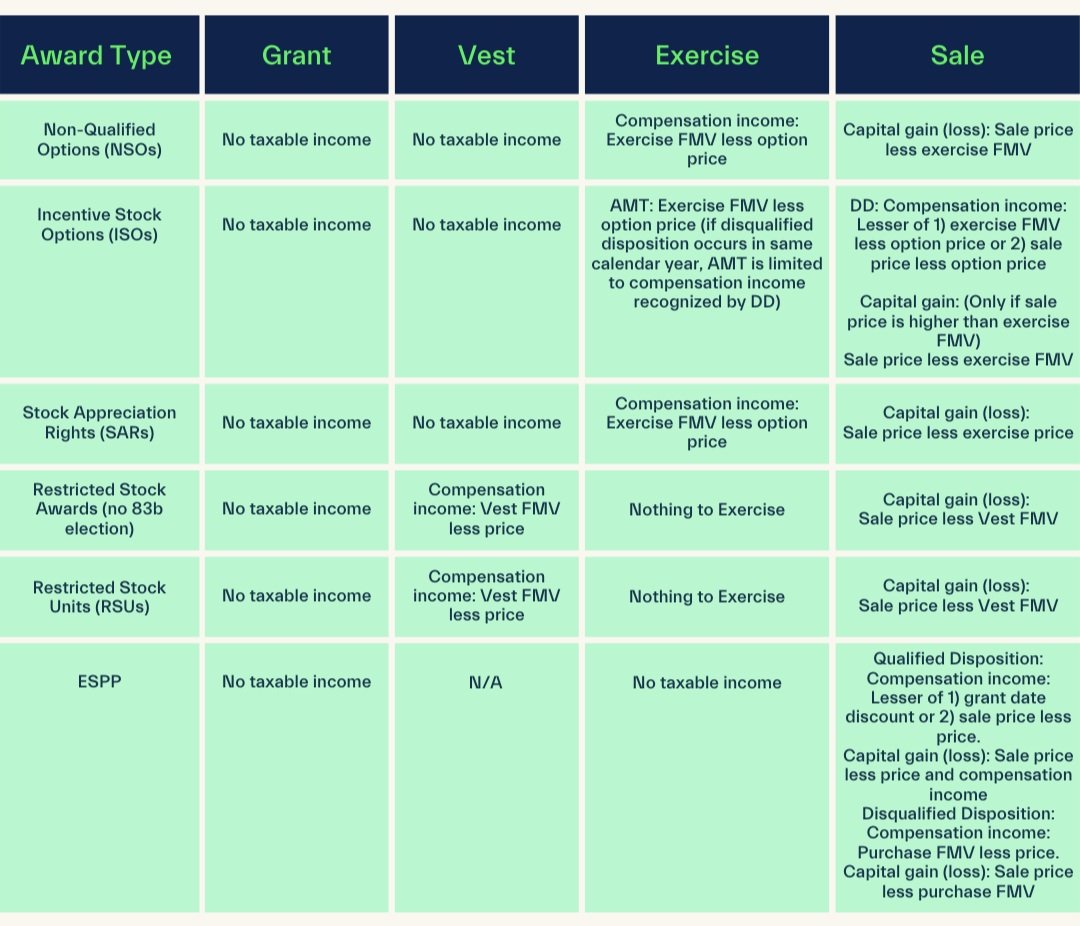

Every award type is unique when it comes to tax ramifications. (It’s worth noting that the granting of an award is never considered taxable income. It’s when you exercise your options that counts.) Take a moment to check the specifics of your award. The chart below can help bring things into focus.

4. Be Aware of Withholding and Reporting Requirements

Withholding and reporting requirements around tax liability apply to employers. It varies depending on the type of award issued. Either way, it’s important to understand what type of taxes will be withheld and reported by your employer—this can help prevent surprises down the road and help you stay in the good graces of the IRS.

Below is a quick reference chart that will help you make sense of how tax withholding and reporting will be handled based on the type of award, the transaction type, the type of taxes withheld, and how the event will be reported.

Helpful Hint

Watch out for incorrect basis reporting on your 1099-B from: If you sell stock acquired through the exercise of NSOs, don’t rely on the basis reported by your broker. For options granted after 2013, brokers are prohibited from making the correct basis adjustment that takes into account the taxes paid at exercise. You’ll need to calculate and correctly adjust the basis to ensure you report the correct gain. If the basis isn’t adjusted, you could end up overpaying your taxes. This little oversight could cost you thousands! Be diligent and do your homework.

5. Diversify

Accumulating equity awards will likely push your investment portfolio into a stock-heavy position. (We consider anything over 5% of your portfolio to be a concentrated position.) This could expose you to significantly more investment risk. Diversification is the name of the game. Strategic planning can help you create a well-balanced portfolio that minimizes risk. As the saying goes, “Don’t put all your eggs in one basket.”

This stuff can be a lot to digest. Know that Brooklyn FI is always here if you need help making sense of your equity compensation package.