Common RSU Misconceptions

By AJ Ayers, CFP®, CEP, EA

Let’s talk about RSUs, which are supposed to be the easiest form of equity compensation. Leave it to the American tax code to turn a fairly simple concept into a tax nightmare. RSUs are Restricted Stock Units. Typically they are granted as an add-on to a person's salary at a public company. RSUs are one part of the total compensation that may include a basic salary, a cash bonus, and maybe even some stock options. I want you to think of RSUs as simply bonus income.

Unlike stock options, which you get to control when you receive the income, RSUs become taxable to you as they vest and you receive shares of your company's stock (after some shares are sold to cover taxes) instead of dollars. While I believe RSUs are the most straightforward type of equity compensation, they are so misunderstood. So misunderstood, I'm surprised Olivia Rodrigo hasn't written a song about them yet.

Remember, RSUs are income to you, but instead of receiving dollars in your paycheck, you receive shares of your company's stock into your brokerage account. Cash is generally pretty stable, a dollar is a dollar. But your company's stock price may be volatile so managing your RSUs and their taxation can be a literal nightmare.

Let's dive into the misunderstood teen girl of the equity compensation space.

Misconception #1: If I hold my shares for a year after they vest, I get to pay the lower long-term capital gain tax rate.

NO NO NO. Definitely not, no way.

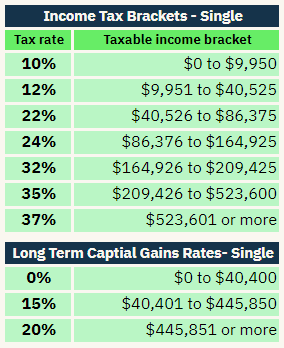

I hear this one all time: "I read that I should hold my shares for a year to get the lower capital gains rate of 15% instead of paying the higher short term rate." There are many untruths in that sentence! Let's unpack this common misconception. Yes, it's true that when you hold an asset for one year and one day after you bought it, you get to pay the long-term capital gains rate. This rate is usually lower than the short-term rate, which is equal to the ordinary income rate. BUT, when it comes to RSUs, the vesting date counts as the day you "bought" the shares. Yes, I know you didn't have to pay for your RSUs with money, but the RSUs were granted to you on the condition you remain employed at your company. So you bought them with the work you continue to do for your company. Remember, RSUs are income so they are taxed at the regular ordinary income rates when they vest, no matter what (check out the income tax table below). So as the stock vests, on the day it vests, those shares are income to you at the price the open market has determined for that day. So if the stock price was $50 yesterday but it's $45 today, which is the day listed in your vesting schedule, sorry bud, you're getting 1 share which you might immediately sell for $45.

I'm just going to pull some random stocks and random data and let's look at the price difference. Let's look at IBM which was trading at $118 on 1/1/2021 and went up to $136 on its long-term capital gains birthday of 1/2/2022. So most folks think wow, I should have held that stock for a year so I could pay only 15% on the higher gain and look like a genius. Good for U!

But that's not how it works with RSUs. The price on the vesting date is counted as income to you, and therefore taxable at ordinary income, or short-term rates. In our IBM example, $118 is taxable to you on 1/1/2021. If you did decide to hold for a year after that, that's cool, you'll still get something for your troubles, but you only get to pay the long-term rate on the DIFFERENCE between the vesting price of $118 and $136 - which is only $18 of gain. So you waited a whole year not to sell to save yourself about a dollar.

Let's assume a rounded capital gains rate of 15% and an ordinary income rate of 24%. That's reasonable for someone making about $150,000 as you’ll see in the tax brackets below. So that's a tax difference of 9%, which at this share price is $1.62. Now IBM is a happy story but look at Spotify or Nintendo. These stocks did not fare as well. Holding for a year would have been devastating. This person would have paid tax on the vest price of $311 and sold at a much lower price, locking in a $67 loss. Brutal.

That is why any financial advisor who knows what they are talking about will tell you to sell your RSUs as they vest, no matter what. You paid tax on that price, it's extremely risky to try and hold out in the hope the price will go up. Of course, sometimes it does. Look at Microsoft. That's an impressive gain that someone would feel pretty validated about holding for the long term. Microsoft is also one of the oldest and most successful technology stocks in the world. And remember, you probably have more RSUs vesting in the future so you'll get to grab some Microsoft stock at a potentially higher price. No one can predict exactly when it’s going to have a higher price.

It's arrogant and downright harmful to assume you know something about the stock price that the market doesn't know. It's also illegal, that's called insider trading, to make a sale or purchase of stock with information about a company that the public doesn't have.

And remember: that capital gains rate is determined by adding your capital gains on top of your income. So if you already have $445,850 of income from salary or another source like stock options, then ALL of your gains would be taxed at the higher 20% long-term rate.

Let’s also not forget about the “cherry on top taxes” when it comes to gains. High earners won’t just pay 20% in capital gains, they will also pay an additional 3.8% on all gains if their income is above $200,000 as a single person or $250,000 as a married couple. So you could be looking at close to 25% on your long-term gain anyways.

Misconception #2: When an offer letter lists a dollar amount value of RSUs, I get a portion of that dollar amount each time my RSUs vest.

Wait, what?

NO NO NO

I'm struggling here to even explain this misconception because it's so confusing and misleading. As a financial advisor in the equity compensation space, I see a lot of offer letters. Offer letters range from brief emails with a salary number to 75 page PDFs with flashy colors and illustrations of how much money you stand to make if the 22-person start-up you’re joining just happens to be the next Salesforce and will go from being worth $50 million today to $10 billion in five years. Hey, I'm not saying that's never happened, just that it's extremely rare.

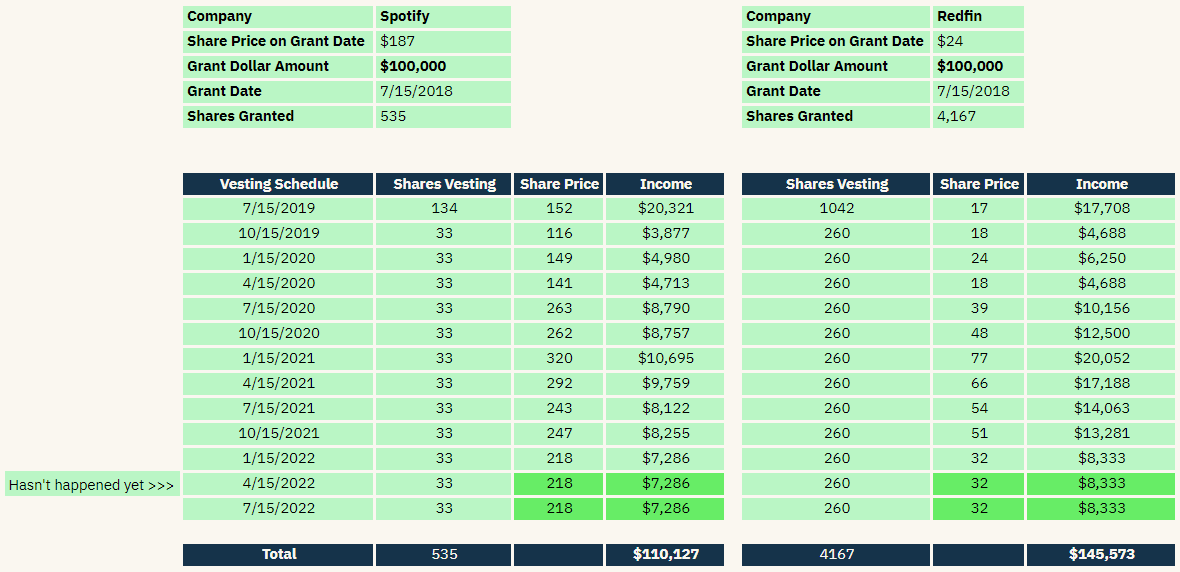

Anyways, back to offer letters and RSUs. Let's assume the company is public because that's easier. Let's assume that the company is Spotify. You might see something in an offer letter like "$100,000 of RSUs vesting over 4 years with 25% vesting at the one-year cliff, then quarterly after that." So let's break it down. One might think, okay I get $25,000 on my one-year anniversary, then $75,000 divided by 12 quarters every quarter after that, which is roughly $6,250. WRONG. That's not how it works.

The number of shares granted is determined on the grant date by taking the cash award value and diving it by the share price on THE DAY OF THE GRANT. Then the number of shares is spread out according to your vesting schedule. So the value of the grant on day one is $100,000, but depending on how the stock performs, you could end up with much less or much more.

Let’s look at two different examples and see how they play out over time. I’ve pulled historical stock prices to illustrate how vesting plays out with two volatile stocks.

Spotify Vs Redfin

Grant Date: 7/15/2018

Grant amount: $100,000

You can see that on the day of grant, the RSU grant was worth $100,000, but as the stock price moved over time, it ends up that Redfin experienced significant growth, so when the vesting ended, the employee walked away with about $45,000 more than the original $100,000 grant.

Misconception #3 When my RSUs vested, they sold way too many to cover the taxes. I barely got half of them so there's no way I owe more in tax.

Most people with vesting RSUs will, unfortunately, owe additional taxes each year because, in fact, they are under-withheld. Here’s why: most companies default to withholding taxes from vesting RSUs (remember, RSUs are just plain old income paid in shares instead of cash) at 22% which is the supplemental wage rate. In fact, most companies will refuse to change your RSU withholding unless you have more than $1,000,000 of income. That’s fine, except if we go look back at our tax brackets, we’ll quickly realize that high earners (anyone making about $85,000 in salary) are actually taxed at higher rates than 22%. So even though their regular salary has the correct withholding to ensure they don’t owe additional taxes, the RSUs do not have the correct withholding. And sometimes the results can be pretty dramatic.

In this example which uses the historical prices of Spotify for the year 2021, we see how the withholding doesn’t even begin to cover the tax due. This person with a nice healthy salary of $210,000 is already squarely in the 35% tax bracket, so every single RSU sale will be underwithheld by 13%. So here we see how this person would be hit with an unexpected $41,821 tax bill!