Year-End Tax Planning Strategies for Businesses

If you’re a business owner, this one is for you!

Our stellar tax and accounting team breaks down the strategies to implement in your business to get organized and ready for tax season. At Brooklyn FI we help tons of businesses understand their cash flow and plan for the future. So many business owners are so good at running their business and don’t have time to worry about taxes. That’s why careful year-end planning is so important.

Even though the year may not be totally over, you can use a forecast to estimate what the total revenue will be for the tax year.

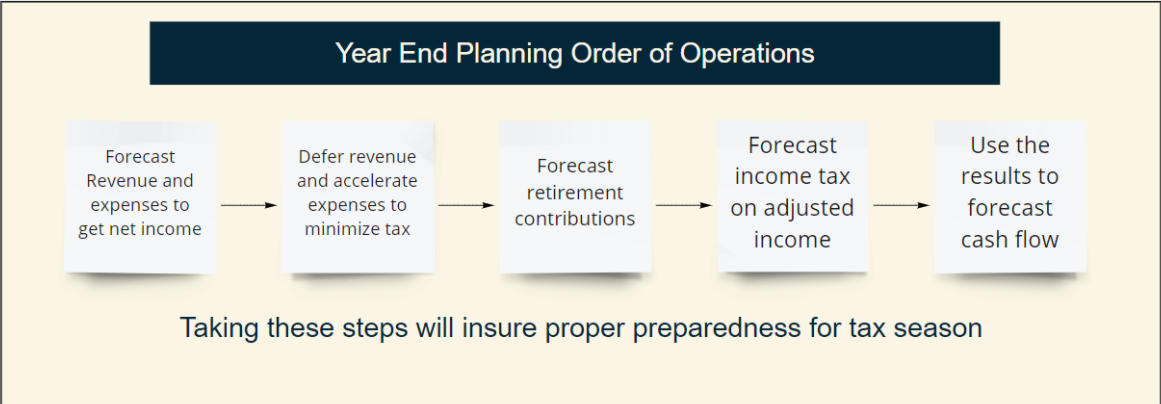

Tax Forecasting

Income taxes are typically the largest expense of a business owner.

You need to project your net income to estimate your income tax.

Because taxes are derivative of net income, planning for revenue earned and expenses will give you a jumpstart for a successful tax season.

Cash Flow Forecasting

Small business owners need to be aware of where cash will be in the future based on forecasted earnings.

Large expenses, large invoices getting paid, and tax bills all need to be estimated to determine where cash is going to be in the future

Most small businesses fail due to a cash crunch

As a small business owner, now is a great time to reflect on the items that drive your cash flow. Here are some ideas.

Income - Things to Consider:

Are we a seasonal business? Do we have historically stronger periods during a financial year?

Do we operate on retainer clients?

Are we a project base business? Can we predict what work will be booked for the remainder of the year?

Expenses - Things to Consider:

Do we anticipate any large spikes in certain expenses for the final quarter of the year?

Do we expect to payout end-of-year bonuses to our employees?

How regular are my monthly expenses? Can I assume ordinary expenses for the remainder of the year?

While income and expenses drive most of our year-end tax planning conversations, we also emphasize the importance of retirement contributions as a business owner. Many business owners sacrifice their own compensation to maintain the business. When the decision comes to either hire an employee to increase productivity or make a contribution to their own 401(k), most of the time a business owner is going to forgo the retirement contribution. We use proactive planning to make sure business owners are thinking about their personal future alongside the business.

We here at BKFI aim for our clients, especially our financial planning clients, to hit a 20% savings rate on their net income. This means they save and set aside for their retirement about 20% of their yearly net income.

20% savings rate accelerates retirement wealth growth and allows for timely and even early retirement goals, especially for high earners.

Maximizing retirement contributions is a key strategy in year-end-planning meetings by setting & paying the right amount of wages and balancing the net business income that flows thru to a client’s personal tax return.

Year end planning meetings ensure everyone is prepared and able to make the retirement contributions by the proper due dates, receive tax savings for making the contributions, and ensure seamless cash flow in their business & personal life.

There you have it, some of our basic year-end tax planning strategies. Watch the team outline these strategies (and more sophisticated ones) in this webinar.