2024 Q3 Market Commentary

John Owens,

CFP®, EA, ECA, CPWA®

MANAGING PARTNER

Market Review

What you’ll find:

Asset Class Performance Review

What goes around, comes around… it can be said for karma, but it also tends to apply to diversification and the 3rd quarter was a pleasant reminder of those benefits.

After the first half of 2024 when the market’s gains primarily came from upward movement in big tech names, the 3rd quarter saw a rotation - where returns for the year in diversified portfolios were pushed higher by areas other than tech.

We saw the most significant rally from the REIT space—real estate investments—which had declined year-to-date through June 30th, only to roar back in Q3. Now up 14% YTD, it posted a 16% rally last quarter.

Outside the US, we saw a late-quarter rally from the Chinese stimulus push, which led to emerging markets up over 17%, the second-best performing asset class. Developed markets like Europe, Australia, and Japan gained nearly 10% this quarter and climbed to 14% year-to-date.

Bonds benefitted from the Fed’s move to cut interest rates - with US bonds popping 5.6% on the quarter to move into positive territory for the year. International Bonds popped 7% on the quarter - now up 3% in 2024. Municipal jumped into positive territory, up 2.3% on the year.

Seeing the more fairly valued parts of the portfolio pick up steam - while tech took a much-needed breather - is a reminder of the perks of diversification.

The Beige Flag Economy

For those unfamiliar with the lingo of the dating scene in 2024 - a common topic is green, red, and beige flags. As you can imagine, green is good, red is bad, and beige is somewhere in between.

Where we sit right now, there are quite a few beige flags that abound in the economy.

First, let’s look at the typical consumer. A couple of years ago, they were flush with cash (from stimulus and a COVID spending pullback). Their debt was down, disposable income was up. And folks spent it.

That led to some inflation (which was exacerbated by supply chain issues), eroding some of that savings, but also pushing wages higher for workers and tightening the labor market.

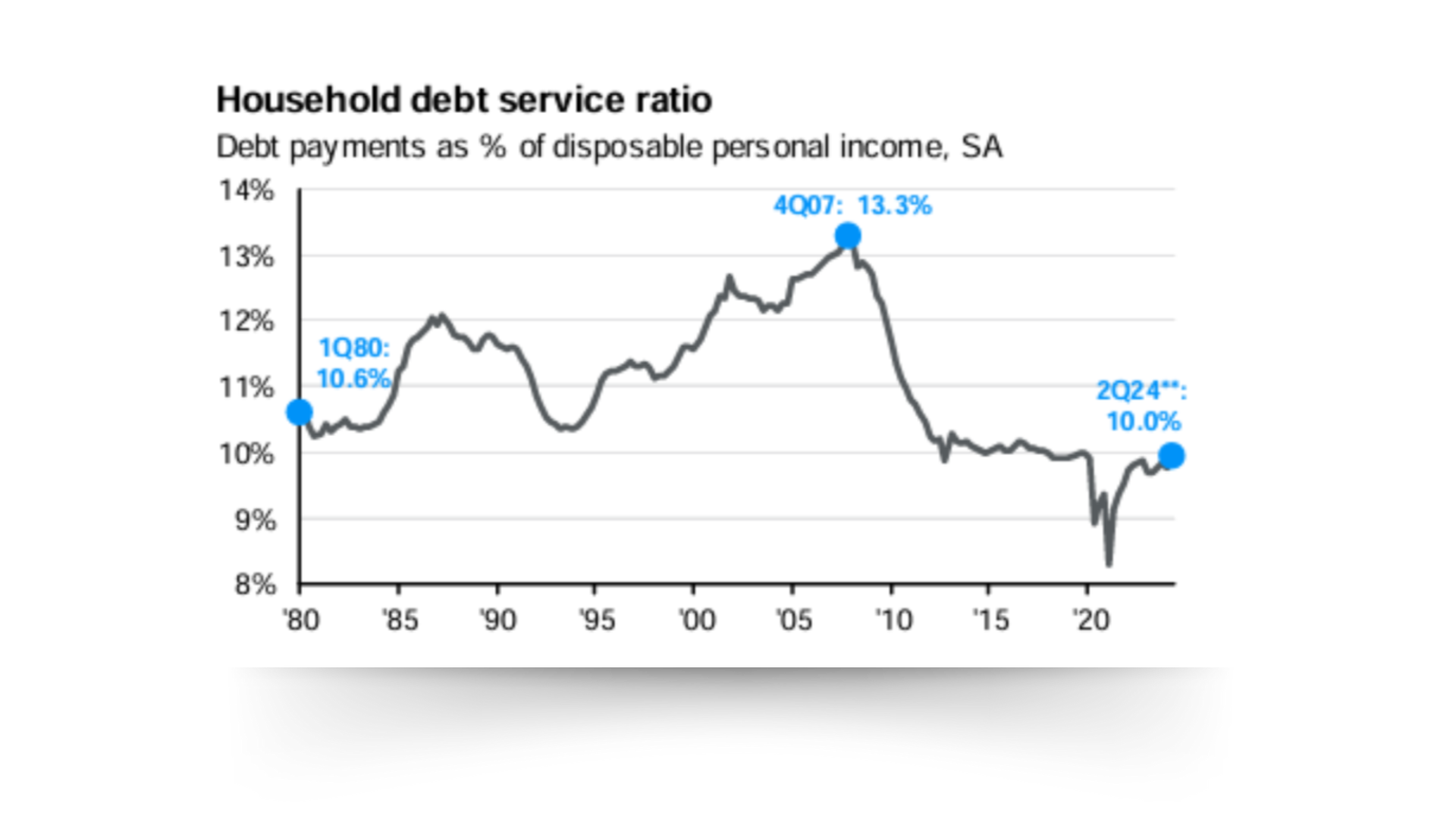

Now, we’ve started to see a few of these factors change. One is debt payments by consumers - which are now closer to their pre-pandemic levels despite a big drop a couple of years back. We’ll call this a beige flag because it’s nowhere near the pre-Great Recession levels, but it’s not as rosy as it was a few years back.

The labor market is also telling us a story as unemployment rates start to creep up from historical lows under 4% up to 4.2% - while job openings are declining from insane highs to where they were pre-Covid, and weekly job gains are moderating significantly.

This may be “normal” in pre-pandemic times - but it is a bit of a beige flag in this economy as it hints at the likelihood that the economy is slowing down slightly.

The beige flags of the labor market and the green flag of stabilized, more normal inflation were major factors in the Federal Reserve making moves late last quarter. The Fed’s Open Markets Committee (FOMC) opted for a 0.50% rate cut in September and has signed further willingness to cut rates in the coming quarters.

Both the Fed and the market anticipate continued cuts (likely a little more muted than the Fed’s September move) in the next few quarters - but disagree on timing. The market is pricing in a more aggressive cutting approach, while the Fed has mapped out a slightly more moderate pace down to about 3% assuming no significant economic shocks that require an adjustment in either direction.

Mortgage Rates

We’ve been getting plenty of questions about refinancing these days as rates are starting to come down. The latest data indicates that the average 30-year mortgage is at just over 6% - an improvement from 7.8% about a year ago.

While the decision to refinance is tied to a variety of factors - we’re generally exercising caution on that front right now for a few reasons:

Rates are anticipated to keep coming down (see the earlier chart on the Fed)

There’s a fixed cost to most refinancing deals - so it may not be worth paying those closing costs if we anticipate lower mortgage rates later.

There are some factors that would incentivize refinancing sooner:

Cash flow improvement that comes from moving from a shorter mortgage to a longer-term one.

Concerns about being able to refinance in the future (job change or job loss).

A REALLY high rate where you’ll get relief immediately regardless of closing costs.

Checking in on Valuations

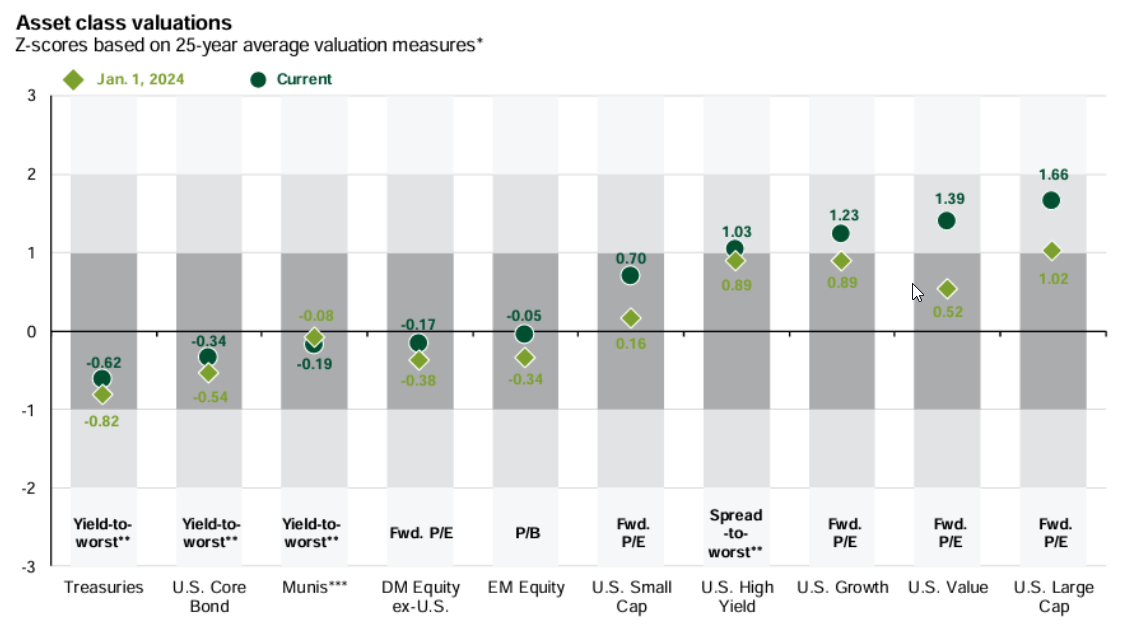

One topic that’s come up quite a bit is valuations. While many US stock funds are on the expensive side of things, our portfolios aim to be diversified and include stocks and bonds from around the globe.

Emerging Market and Developed International Stocks are both fairly valued - in line with their long-term average while most bonds are trading at a discount in the current rate environment. A truly diversified portfolio should have assets at various valuations as styles rotate in and out of favor from time to time - just as we saw Growth Stocks slow in Q3, while Value stocks rallied and played some catch-up.

Chart of the Quarter

The IPO Market remained rather muted in Q3, bucking the trend from 2020 and 2021 where post-Labor Day roadshows produced some massive liquidity events. This quarter saw the most uptick in deals while proceeds remained flat as 2024 looks likely to provide only a modest uptick from the slowdown we experienced the past 2 years.